Few industries are more dependent on securing user data and protecting user privacy than the financial services sector. To stay competitive, IT professionals in the world of finance are required to keep pace with growing security concerns, strict compliance standards, and an ever-changing technology landscape.

To get a better understanding of the top issues facing IT teams in financial services, Auvik recently released its 2024 Financial Services IT Trends Report. The report surveyed 2,000+ IT professionals about current IT trends, and compared the results from professionals working in the financial services industry to the larger sample group. The report spotlights several challenges facing financial services IT professionals in comparison to their peers.

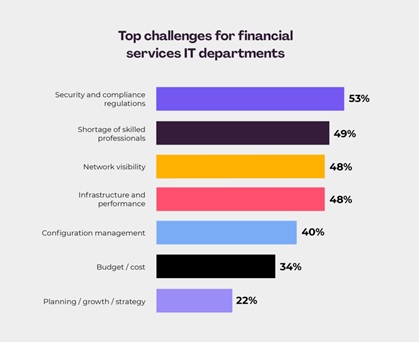

Not surprisingly, the experience of FinServ IT teams is significantly impacted by the onslaught of cyberattacks facing financial services organizations as well as the complex regulatory environment of this industry. More than half of financial services IT professionals cite security and compliance regulations as their top challenges today (53%), followed closely by the shortage of skilled IT professionals (49%), network visibility (48%), and infrastructure and performance (48%).

IT teams in FinServ need to balance remote accessibility and the end user experience with data privacy, security, and compliance concerns. However, the threat surface continues to grow for financial institutions as more devices, applications, and endpoints are connected to corporate networks over time. Security threats are being further compounded by employees spending far more time working on the web (62%) than on secure desktop applications (38%).

Another issue involves an ongoing shortage of skilled IT professionals in the workforce, leading to more relationships with managed service providers (MSPs) who partner to protect data security while managing network performance for end users. In fact, financial services comprise one of the industries most likely to outsource network-related functions to MSPs at 80%, tied with healthcare (80%) and only behind heavily regulated utilities (87%). The top outsourcing activities for financial services respondents involve network configurations, configuration backups, and troubleshooting.

Protecting and Improving FinServ IT Networks

Banks and financial institutions need to provide continuous high network availability to maintain security protections and ensure a smooth user experience. Making frequent updates can help improve processes for security, troubleshooting, software upgrades, and regulatory compliance.

IT teams may incur costly expenses due to any extended periods of network downtime or user latency. For this reason, most IT teams in the financial services sector tend to back up their network configurations either daily (24%) or weekly (39%). Network configuration backups provide protection against data losses, while also limiting the time it takes to recover from a technical failure, system error, or cyberattack.

Network documentation is another important practice for financial services IT professionals, who update network documentation more frequently than their peers in other industries. Nearly half of IT pros in FinServ (45%) update their network documentation for maps and inventory on a weekly basis, compared to just 36% in other industries.

Another distinct difference between FinServ IT teams and those from other industries involves their portfolios of network devices. Almost half of finance IT pros utilize just four to 10 network-related tools, compared to their counterparts in other fields who use 10 to 20 tools on average. This discrepancy suggests that finance IT departments tend to consolidate network vendors to maintain a limited, refined toolset that can reduce complexity while increasing control over network operations for security and compliance.

One other distinguishing feature for FinServ IT teams involves their commitment to continually innovate. In the survey, finance IT leaders expressed a higher interest than their peers in pursuing network innovations for many activities. The leading activities included making improvements to programming and automation (48%), security (47%), configuration and maintenance (46%), training and continuous learning (45%), and strategic business planning (45%). The top obstacles holding back the pursuit of these activities involved the usual suspects — an ongoing lack of budget (40%) and a lack of authorization to move ahead (40%).

IT teams in financial services face a unique and significant responsibility to protect their clients’ money and investments. Part of this mission involves working closely with the CISO and Security Operations Center to maintain adequate network safeguards, while another aspect involves making continual improvements to maintain network performance and user satisfaction.