During the past three months of the COVID-19 pandemic, the business world has grappled with the question of whether to or when to reopen offices. Numerous companies have publicly announced permanent remote work options or signaled a move to hybrid work models, but most have yet to determine their plans. While the decision-making fundamentally rests on how well countries and states manage the virus, CEOs also need to consider the long-term impact on employee productivity.

With companies in Europe, the Middle East and Asia (EMEA) reopening offices based on declining rates of infection, data is starting emerge that helps inform this decision-making. When comparing EMEA and North America, and specifically the U.S., there is evidence of a remote work productivity tax.

In the U.S. and countries in Europe where the share of remote work remains extremely high, employee productivity continues to fall. At the same time, productivity is rising in European countries where the share of in-office work is accelerating. Figure 1 illustrates hours spent on business applications from the beginning of February through July 10, with a breakdown of in-office vs. remote work. Our initial data showed that productivity initially increased in North America (+23% by the end of March), while it declined in Europe by 8.2% in the same period.

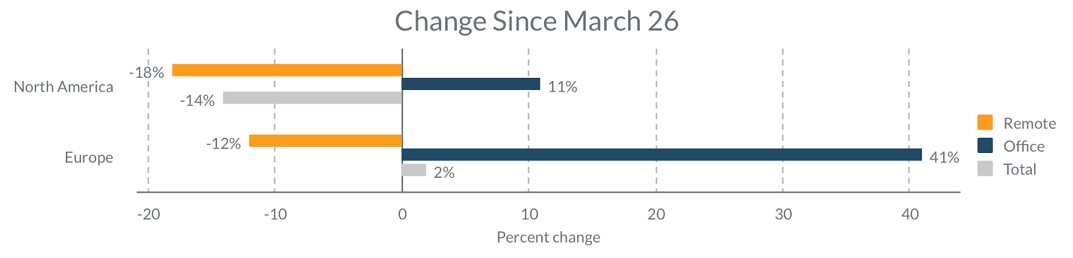

That initial trend has not held, however. Between March 26 and July 10, productivity in North America declined by 14%. With a near constant 85% of employees continuing to work from home, this suggests that workers are getting less productive the longer the remote work shift continues – imposing a remote work productivity tax on companies. In Europe, overall productivity increased by 2% from March 26 to July 10.

Figure 1

Evidence of the Remote Productivity Tax

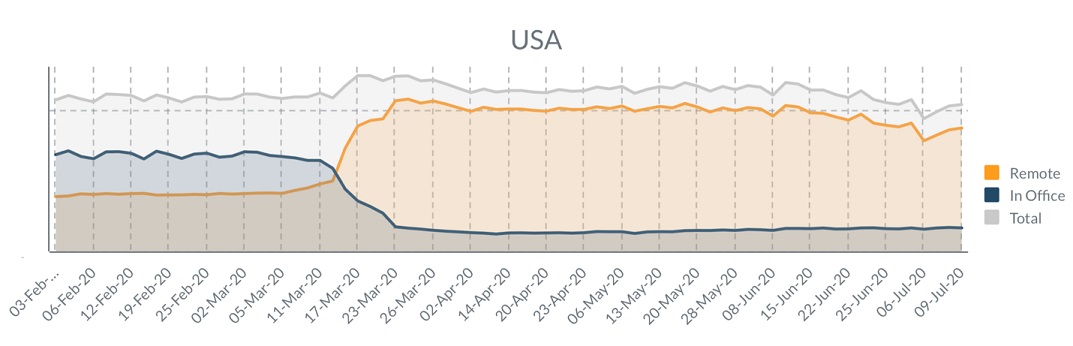

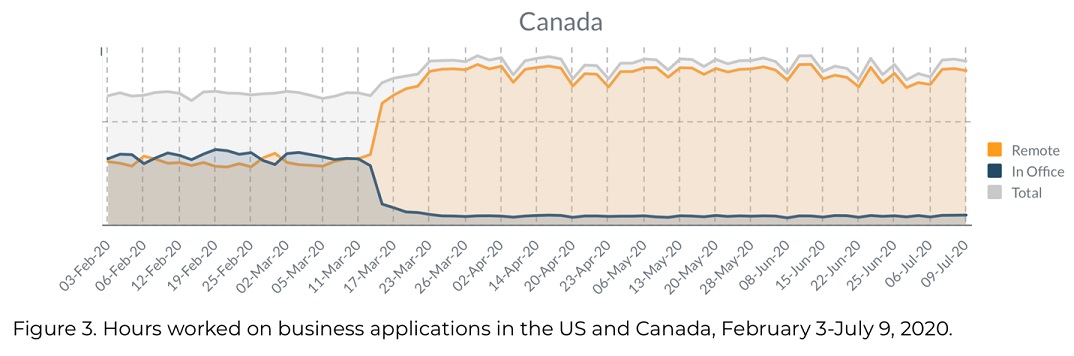

Figure 2 provides greater insights into this trend. The entire productivity decline in North America was driven by the 14% decrease in productivity among U.S. employees since the shift to remote work started in mid-March. Canadians have better adapted to remote work, maintaining about the same overall productivity during the same period.

Figure 2

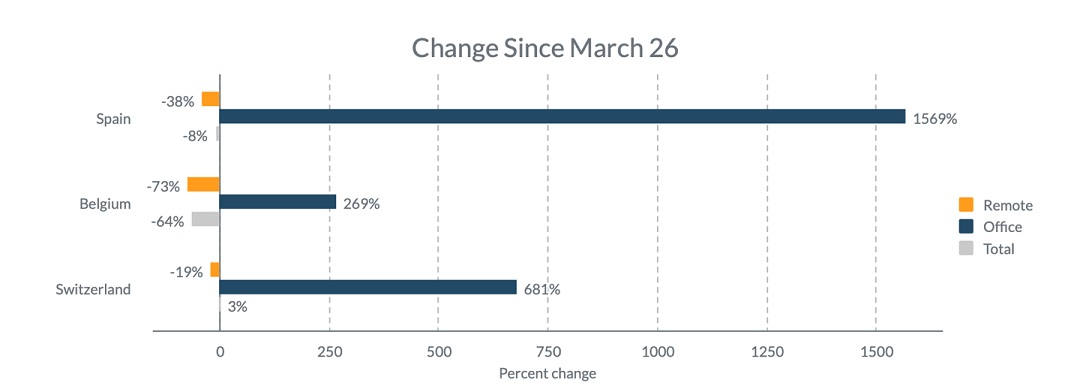

Additional evidence of a remote work productivity tax is shown in data from European countries where remote work is still the dominant model. In Spain, Belgium, and Switzerland, where remote work is at least twice as high as in-office work, overall productivity has decreased since March 26, despite increasing in-office work.

Figure 4

These numbers showcase why employee experience is more important than ever. With employees working from home, business and IT leaders must address fundamental questions around whether the workforce has the right IT resources to get their jobs done.

Does sufficient VPN capacity exist to handle the remote employee population?

Do employees have laptops with sufficient resources and performance to do their jobs properly?

To what extent does application performance vary from expected baselines when employees access those apps remotely?

Without insights into how employees are interacting with their digital workplace, businesses won’t be able to proactively identify tech issues that can hinder productivity.

Of course, it’s not just about the availability of technology. The performance of technology is what matters to employees attempting to do their jobs remotely. IT must ensure that employees experience fast response for the business-critical applications on which they depend on, collaboration tools must be reliable enough to foster effective communication, and device and connectivity performance must be reliable. IT must also keep pace with an increasing volume of end user issues, all at time when the pressure is on to control costs.

In this era of remote work, technology performance plays an outsized role in employee experience. Companies need insights into where to invest and where to cut costs in order to maintain business continuity.